Saas & Digital Agency Services.

Lorem ipsum dolor sit amet, consectetur adipiscing elit,

sed do eiusmod tempor incididunt ut labore et dolore magna.

Kick Start your Strategic Digital Marketing Campaing

Neque egestas congue quisque egestas diam in. Semper quis lectus nulla at volutpat diam ut venenatis.

Digital Marketing

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Enterprise Technology

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Business Innovation

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

We need to stop interrupting what people are interested

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Nulla facilisi morbi tempus iaculis.

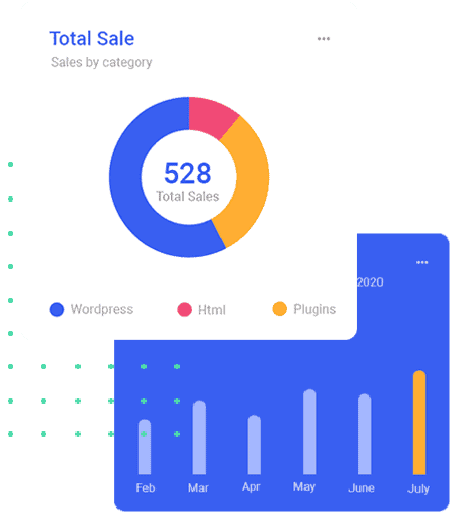

97.8%

Open Rate

Achieved

7.35%

Abandoned

Cart Rate

Get tips & tricks on how to skyrocket your sales

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Nulla facilisi morbi tempus iaculis.

22%

Click Through

Rate

$1.2

Revenue

Per Click

Who We Are?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Nulla facilisi morbi tempus iaculis.

Check testimonials for our satisfied clients

Neque egestas congue quisque egestas diam in. Semper quis lectus nulla at volutpat diam ut venenatis.

Ryan Edmonds

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Marie Garibay

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Clarence Harris

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

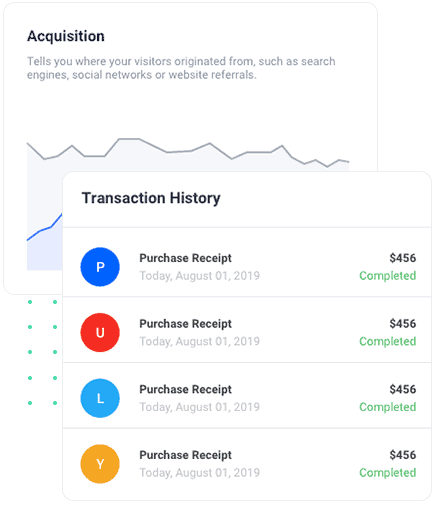

Discover effortless

customer support

Neque egestas congue quisque egestas diam in. Semper quis lectus nulla at volutpat diam ut venenatis. Blandit massa enim nec dui nunc.

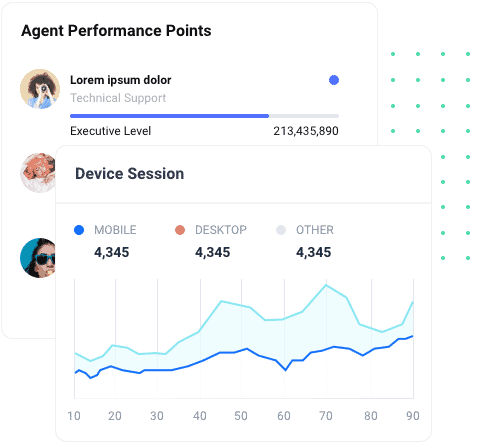

We build digital products

for your success

Neque egestas congue quisque egestas diam in. Semper quis lectus nulla at volutpat diam ut venenatis.

Standard

$39

Best for individuals

Popular

Pro

$59

Best for professional

Business

$99

Best for business

Get an easy start

with Saas now

Everything you need to confidently run your business.

Create your free account now!